Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Investment Trends to Watch for in 2024: Choose Your Own Reality

The social and economic turmoil and upheaval of the past few years has forced many of us to reexamine our beliefs and values. It seems the whole world is realigning into new demographic and social categories, and each shift can be an eye opener as people discover where they stand on issues as they play out. You probably have a pretty solid sense of where you land on the traditional political spectrum between left and right, but people are now beginning to recognize that the simple red to blue spectrum is inadequate for today’s very complex environment. Have you thought about where you fit on the continuums that span from authoritarian to libertarian, individualist to collectivist, and risk-seeking to risk-averse? Take a look at the infographic here to explore where your beliefs fall relative to various polarities.

These divisions in worldview are beginning to come ever more into play as populations are faced with social media echo chambers, propaganda, dis- and misinformation, politicized news sources, deepfakes, and other ways that information is being tailored and slanted to both fit and create our understanding of reality. And how you view the world and understand reality will definitely impact how you invest in it.

This year, as Arnerich Massena’s Research Team examines the cultural trends we think will impact the investment landscape in 2024, we wanted to contextualize them by pointing out that they can all be viewed from a variety of different perspectives. The story of the blind men and the elephant is particularly relevant in this age. In the story, five blind men are introduced to an elephant and describe it in various ways, depending on the angle from which they encounter the animal: “An elephant is like a thick rope,” “It’s like a wall,” “It’s like a tree trunk,” “It’s like a large snake,” and “It’s like a spear.” Everybody sees their slice of the world, but nobody has access to the whole reality. And the reality you choose is going to impact the future you create.

Please keep in mind that the investment trends we outline are not intended as investment recommendations, but as an interesting look ahead to imagine what the near future might look like. Continue reading below, or download the full article here.

Corporate power overtakes nations

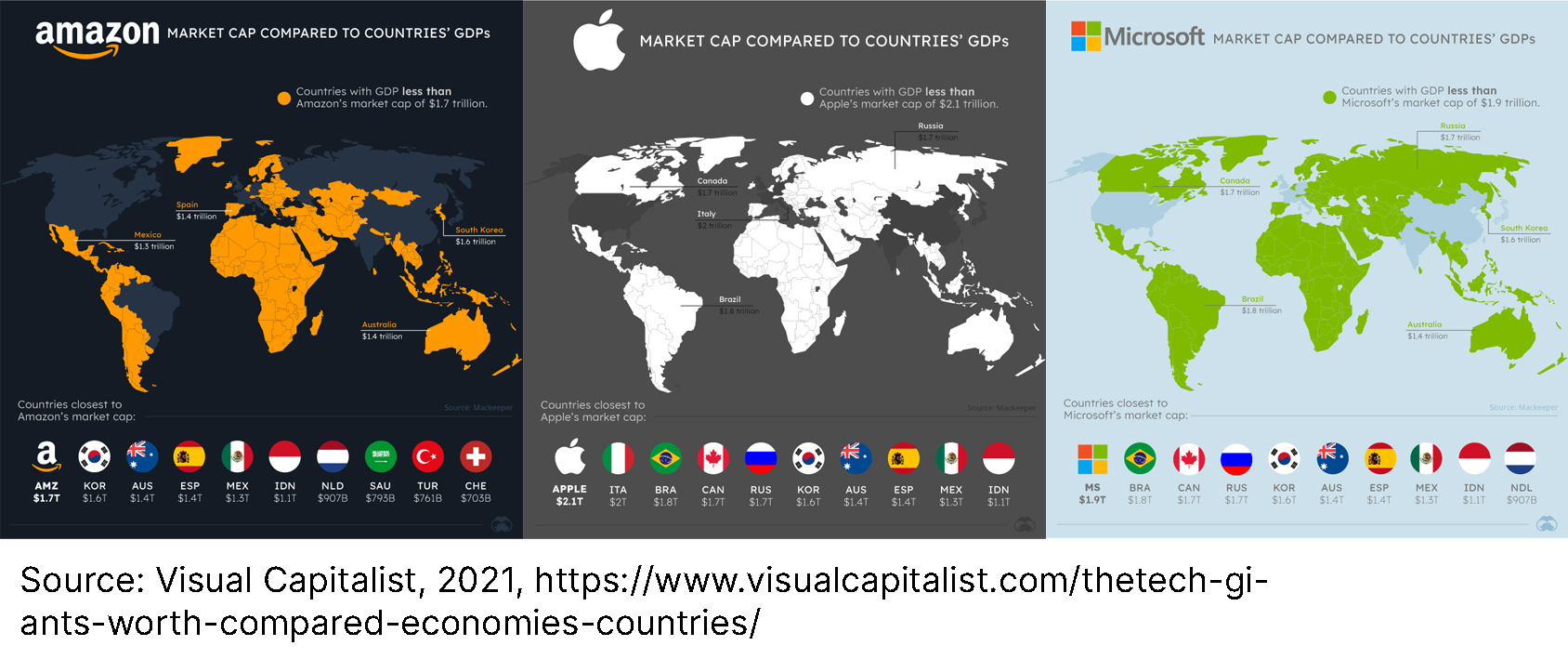

Mega-cap multinationals are not just dominating the investment landscape; some of the largest companies have valuations and budgets that well exceed the GDP of entire nations. Corporations have assumed a level of power and importance in our global order that approaches that of countries, in many cases even greater. Only seven countries have a GDP higher than Apple’s market cap, for example – and Microsoft, were it a country, would be the tenth richest in the world. What are the implications for democracy when shareholders and CEOs have a greater say on issues that affect us globally than voters and their representatives? This is true not just of corporations, but of individuals as well; over the last few years, we have seen a steep increase in billionaires’ wealth, with more than 52% of global income going to 10% of the population. Many billionaires control wealth that rivals or exceeds the GDPs of nations. The unintended result of wealth inequality is the widening political power differential; a study from Professor Martin Gilens from Princeton University and Professor Benjamin Page from Northwestern University in 2014 found that “the majorities of the American public actually have little influence over the policies our government adopts” — that it is actually the economic elites and organized interests who sway policy decisions. That trend has only accelerated since then.

We have seen the impacts over the past ten years of the stock market tilting heavily toward mega cap stocks, as the advantages of economic strength, political power, and economies of scale elevate them beyond the competition – and often eliminates competitors altogether. The question now is whether we’ll see the pendulum swing the other direction as antitrust activity increases. This year, for example, the FTC proposed a broad ban on employee noncompete agreements, and the FTC and DOJ began an overhaul of federal Merger Guidelines. The UK and European Union have promised greater scrutiny on deals as well.

The trend toward consolidation of the market has driven some investors toward mega cap stocks, while others have sought out opportunities in niches like private equity, where smaller companies are still able to compete and thrive. Your worldview will play a role in how you perceive market consolidation and incorporate it into a long-term investment strategy.

The politicization of AI

The rise of artificial intelligence is well underway; we pointed out in our second quarter MarketCast that ChatGPT reached a million users after only five days online. But citizens are fast realizing the impacts artificial intelligence could have on politics and elections. With artificially generated political content, AI-driven precise audience targeting and data gathering, and AI tools designed to feed individuals the echo chamber of their choice, human beings are becoming ever more herded and manipulated.

In the 2016 and 2020 elections, we saw the effects of data harvesting and social media targeting, as well as “astroturfing” — the use of bots to generate social media movements that appear to be grassroots and organic but are actually manufactured. Now, the 2024 election will be the first in which we face the potential for deepfake content that is nearly indistinguishable from reality. There is a concern that creators have the ability to put out recordings of politicians saying things they never said or showing events that never happened. Even more concerning is the possibility that most of us will have no way of being able to tell the real from the fictional.

Also, since the advent of ChatGPT and other Large Language Models, we’ll see more and more AI-generated content and news — and there are claims that AI content is slanted with political bias, censoring some information and perspectives. Not to mention the troubling — and hilarious — instances of AI simply fabricating information, such as when lawyers in an injury claim presented cases as precedence to a judge that had been researched using bots, and which turned out to be completely imaginary.

Artificial intelligence offers tremendous opportunities for investment and innovation, but investors will have to examine those opportunities to understand what is aligned with their own values and vision for the future.

Expanding debt

Any examination of the investment landscape in the coming year needs to include a look at expanding debt levels. Though the U.S. has carried a heavy national debt for much of the last century, rising interest rates and slowing growth have amplified the burden of the debt. As we mention in our fall podcast, “The U.S. Budget Deficit, Interest Rates, and the Future,” the Government Accountability Office has recently warned that the U.S. federal government faces an “unsustainable long-term fiscal future.” (Watch the podcast for some great context and analysis on the U.S. debt situation.) The cost of servicing the $33 trillion national debt is closing in on a trillion dollars annually in interest, and the country continues to run a significant annual deficit. Paying that much in interest means less money available for other government services.

The United States is not the only country facing a heavy debt load. Global debt had reached a record $307 trillion by the second quarter of 2023 (including government, business, and individual debt), pushing the global debt-to-GDP ratio to 336%. You can view a global debt clock of government debt across the planet, including a country comparison, here. Rising inflation globally has translated into higher interest rates as central banks work to control inflation, but this also means higher interest costs.

When an individual takes on too much credit card debt, they are borrowing from their own future; it is their future self who will have to spend more of their income to pay off the debt, and who may have to make sacrifices in order to do so if they are unable to increase their income. Similarly, countries are borrowing from their citizens’ futures, who will face higher taxes and fewer services, unless they can generate enough economic growth to relieve the burden.

What impact does debt have on economic growth, provided we are able to pay the interest expenses? A Mercatus policy brief from 2020 reviewed the literature on the relationship between debt and economic growth and found that once a country’s debt-to-GDP ratio reaches somewhere around 90% and higher, government debt begins to have a negative effect on growth rates. This effect can come from high long-term interest rates, higher tax rates, inflation, and constrained fiscal policies. As of 2023 the U.S. had a debt-to-GDP ratio of 128%, the 14th largest globally, with Japan’s the highest (259%), and behind other countries like Sudan (200%), Greece (195%), Italy (150%), and Venezuela (134%).

For investors, understanding the potential drag on economic growth the national debt could have is important in making investment decisions. Diversifying into asset classes that are less reliant on economic growth may be an increasingly beneficial part of a long-term strategy.

Inflation and scarcity

Since the pandemic and war in Ukraine, food insecurity has increased from 135 million in 53 countries to 345 million in 79 countries. With Russia and Belarus being the world’s top fertilizer exporters, the conflict in Ukraine resulted in skyrocketing fertilizer costs due to supply chain disruptions and sanctions. The resulting uncertainty contributed to countries instituting trade restrictions and export bans to combat the impact of rising food costs and increasing shortfalls.

Add to that the Dutch government’s attempts to reduce nitrogen emissions with severe restrictions on its farming industry. The Netherlands is the second-largest agricultural exporter after the U.S., and farmers suggest that the new emissions targets may lead to a large number of farms becoming unable to continue production or even shutting down altogether. Protests among Dutch farmers have been ongoing for over a year. Rising energy prices have also resulted in a drop in European fertilizer production. The U.S. and Canada have increased fertilizer production, but we may be looking at slowing global agricultural production and rising prices in the upcoming seasons.

As food prices rise, so does food insecurity. In the U.S. alone, the USDA reports that food insecurity increased from 10.2 percent of households in 2021 to 12.8 percent of households in 2022 (representing more than 44 million people). The Food Security Information Network’s Global Report on Food Crises states that high levels of food insecurity increased from affecting 216 million people in 2022 to 238 million people in mid-2023. Food prices rose faster in 2022 than at any time in the last 20 years. Food prices continue to rise: the World Bank reports that food price inflation exceeded overall inflation (in real terms) in 77% of 170 reporting countries.

For investors, this environment provides opportunities both for growth and to make an impact investing in agriculture and agricultural technology – whether that be land, water, agricultural inputs like fertilizer, or other aspects of the supply chain. Scientists and agricultural engineers are looking for creative ways to expand our sources of nutrition – from lab-grown meat to insect protein – and are focusing on developing more sustainable practices in agriculture and livestock production.

Medicalization of society

Since the pandemic, public health has become a central concern for both governments and individuals. Our public health agencies have taken center stage like never before, and have established a presence in our lives that is unprecedented. The World Health Organization is proposing a pandemic treaty that, if ratified in May 2024, could dictate how individual countries are required to structure their public health response in the event of a pandemic or other international public health threat. There has been a sea change from individual choice, informed consent, and health privacy to a world in which some medical choices may be mandated and tracked, as we saw during the COVID-19 crisis.

And, as technology becomes ever more integrated into our healthcare protocols, we are starting to see standards of care dictated by algorithms, agencies, and insurance companies rather than physicians making decisions at the patient level. Artificial intelligence is changing the way we manage healthcare, with automated clinical algorithms that analyze data and input and can direct the care process, from diagnosis to testing to treatment, with little to no input from a clinician. Automated clinical processes can enhance efficiency in medical care, a boon to overextended clinics and overwhelmed healthcare workers, but they remove much of the individualized and personalized care we have been accustomed to. Also, as we build these systems, it will be important to examine the risks and be thoughtful in how algorithms are trained and implemented. Errors and distortions can be amplified if our systems aren’t monitored by real people and adaptive to new information. There is the risk of cementing standard operating procedures, creating a barrier to new advances and making it more challenging to innovate.

This may not seem directly related to investing, but healthcare made up more than 18% of our GDP in 2021, and that number is rapidly increasing with an aging population. However, despite higher spending both per capita and as a share of GDP, The Commonwealth Fund’s U.S. Healthcare from a Global Perspective reports that Americans experience the worst health outcomes of any developed nation, with lower life expectancy, the highest maternal and infant mortality rates, the highest rate of people with multiple chronic conditions, and among the highest suicide rates. Clearly, the healthcare sector could benefit from thoughtful innovation. But how investors choose to invest in this area will depend on where they envision – and hope to see - the future of healthcare and medicine.

Biotechnology: Integrating the living and the machine

The next stage of technological advance is integrating tech into biology, and that process is moving forward fast. By 2003, we had mapped the human genome, and now we are working on mapping the human brain in the hope of better treating neurological disorders and injuries (by 2021, Google and Harvard had mapped one millionth of the brain, which took up 1.4 petabytes of disk space). The CRISPR gene editing technique has opened the door to a whole world of genetic engineering and enhancement, as scientists anticipate being able to precisely modify DNA sequences. This fall, the FDA is poised to approve the first treatment for humans using CRISPR, a sickle cell disease treatment known as exa-cel. Anti-aging is a major area of biotech research, looking at ways to reverse the aging process at a cellular level. Synthetic biology is another area of intriguing biotech research, in which scientists construct biological entities – like bio-robots – to assist in conducting biotechnological processes. Synthetic biotechnology applications span from engineering human gut microbes to generating soil bacteria for agriculture. Another cutting edge area is lab-grown organs – also making animal organs safe for human transplantation using genetic engineering. And research on potential brain-computer interfaces is attracting attention and interest as scientists and engineers work on building tools that can serve as direct links between the human brain and an external device so that we can record, decode, and stimulate neural activity; advances suggest potentials ranging from treating neurological disorders to enhancing human abilities.

As with any type of technology, the research may be moving faster than we can wrap our minds around the implications. What are the long-term effects of altering human DNA? Is lab-grown meat a healthy alternative, or does it harbor an unknown dark side?

There are a wide and increasing variety of ventures available to fund and invest in across the field of biotechnology. Investors will be examining not only the profit potential but the human benefit potential to find the best avenues for investment.

The rise of influencer culture

Traditional advertising and marketing are declining in relevance as Millennials and Gen Zers look to social media to guide their buying and brand loyalty decisions. The rise of influencers has been rapid and total; social media influencers are quickly becoming the biggest celebrities, surpassing both film and pop stars. For companies seeking to elevate their brand, online personalities can deliver a targeted audience, viral potential, and undying brand loyalty from fans. For brands to take advantage of the trend, though, means more than just buying advertising with podcast hosts and Instagram personalities. This is a new type of strategy that requires partnership as much as transaction. Brands are aligning with their influencer advertisers so that they become advertiser, spokesperson, ambassador, and salesperson all in one.

Influencers don’t just advertise and pitch products, now they actively sell them as well; livestream shopping is beginning to take over ecommerce. In this shopping format, consumers can purchase and interact with a social media host during a live event. Alibaba’s Taobao Live originated the trend and now, China boasts multiple e-commerce platforms. iResearch estimates that 40% of Chinese were using livestream shopping by 2021, and that total e-commerce revenue could reach $720 billion this year. But it’s not just China; this is a global phenomenon; Coresight Research, which studies retail and technology, projects that livestream sales in the U.S. will reach $32 billion by the end of 2023.

The shift to livestream shopping and ecommerce will be facilitated by mobile applications that serve multiple functions. In China, WeChat began in 2011 as a messaging app but has become a powerful tool that combines social networking, payment systems, ecommerce mini programs, and other services. Elon Musk seems to be aiming in the same direction with X (previously Twitter) as the company adds additional features and functionalities like live audio conversations with Spaces, long-form content, and native video capabilities. And we suspect other big tech companies will be seeking to extend the ways they interact with their audience to capture more of their attention and their disposable income.

Retailers sell products and influencers make commissions, but there is space in ecommerce for investors as well. Venture capital investors are looking at the creator economy as an untapped market — investing in the digital tools to help influencers build their audiences and product lines or monetize their interactions. So far, there doesn’t seem to be a move to invest in influencers directly, but that may be coming sometime in the future.

The conversation around influencer culture and social media can be polarizing; it is radically changing the way we interact and engage with the world, mediating our experience through our screens. It can help us build connections and share knowledge, but the impact it has on the social and emotional development of young people is still not well understood. How we invest in this industry will have long-term downstream effects as we continue to integrate these tools into our lives.

A growing army of copy traders

One interesting trend of the last year or so has been the appearance of copy traders, also known as mirror traders or social traders – investors who build their strategies to replicate (or oppose) the portfolios of famous individuals and well-known investors. Copy traders use real-time signals to replicate a “lead investor’s” trades in their own portfolios. The idea behind copy trading is to leverage the knowledge and experience of more seasoned or professional investors — people have been seeking to replicate Warren Buffett’s strategy for years for this reason. But there are also those who track politicians’ trades, such as Pelosi trackers and Unusual Whales, which tracks trades made by Congress and SCOTUS. And consider the “Inverse Cramer ETF,” which developed because investors sought a way to take opposite trades from those made by CNBC personality Jim Cramer.

Copy trading platforms that automate the brokerage process, like eToro, AvaTrade, and Pepperstone, have sprung up to simplify the process for investors. Many provide access to a variety of assets, including stocks, commodities, and cryptocurrencies. Users are able to follow and copy multiple traders, with thousands to choose from and a range of performance metrics and resources. Most platforms allow users to both copy and self-trade, making custom adjustments to the level of automation.

Copy trading or mirror trading doesn’t necessarily reduce investment risk, and may deliver overly risky or inappropriate strategies for naïve investors. The idea of copying successful investors sounds attractive, but as with any investment, one can only know what has been successful in the past. Being able to build a forward-looking portfolio based on an investor’s needs, risk tolerance, and time horizon becomes overshadowed when an investor is simply looking to follow a leader. Additionally, the question arises of whether inexperienced investors are using appropriate tools and metrics for selecting and evaluating their trading leaders.

There are potentially useful applications for mirror trading – and it can certainly be fun and interesting for investors who understand the risks and rewards – but we hope that the investment industry and investors themselves approach this trend with caution and prudence.

Conclusion

This list is in no way comprehensive, but we feel that it’s fairly representative of some of the key shifts and trends in the cultural, economic, social, and investment landscape. It’s important to recognize that people will view and respond to these and other changes with enormous variation depending on their perspective. It’s possible to paint these trends with positive, negative, and neutral lenses, and the potential futures they point toward can range from utopic to dystopic depending upon your vantage point. The worldview and reality you choose will lead to the future you will create.

While we face challenges in how we operate together as a society, there are plenty of opportunities for investment and growth along the way. Biotech, life sciences, AI, social media, and technology – these industries all have enormous potential in the coming years. And we’ll continue to need energy, agriculture, water, transportation, and communications.

As investors, we are always looking toward the future to envision where capital is likely to flow and where there are opportunities and inefficiencies we can leverage. Taking a big-picture perspective like this allows us to look at the larger context in which we’re investing, and to think about the broad influences on the economic and investment environment. This coming year, we are focused on protecting assets from inflationary pressures, making the most of higher interest rates, taking advantage of new structures like direct indexing, and finding opportunities in real assets and hedge & diversifying strategies. We look forward to seeing you in 2024!